QuickBooks Training Services to your Accounting Practice | QuickBooks Support Number:-+1877-249-9444.

Bookkeepers are increasingly inclined to making the move into the Trusted Advisor part; nonetheless, the majority of my partners contend that despite the fact that they WANT to do this, there are numerous elements acting as a burden. For one, "Who is doing the information section?"

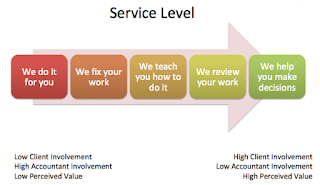

Along these lines, we should accept that the normal private company spending plan for month to month bookkeeping administrations (counting information passage, accounting, finance handling, deals charge preparing, yearly expense forms and general bookkeeping/monetary counsel) is $500. Presently, bookkeeping firms have a work spending plan (being the biggest info cost) for each customer in light of what they are charging for their expenses, which, for this illustration, we have to expect is the whole customer's financial plan. In this way, the current issue is that 80% of that financial plan is devoured doing information passage and accounting, which has LOWEST PERCIEVED VALUE benefit from the entrepreneur point of view, leaving just 20% accessible for expense forms, money related proclamation translation and business arranging/counseling, which has the HIGHEST PERCIEVED VALUE.

This is the thing that I call the "Administration Level Evolution:"

In this way, the arrangement: Delegate the information passage and accounting back to the customer. Sounds straightforward, at the same time, truly, it's a chaotic experience in light of the fact that most entrepreneurs and their staff don't have formal bookkeeping preparing, and by and large place almost no need in exactness and right characterization of exchanges.

The scaffold between "We do it for you" and "We enable you to decide" without breaking your customer's month to month bookkeeping spending plan is TRAINING. In the event that a bookkeeping firm effectively prepares their customers to do the information passage and accounting precisely and opportune, the measure of cleanup work gets fundamentally lessened, taking into consideration some of that work spending work to be put to better use by concentrating on higher saw esteemed administrations, for example, counseling!

Presently, what are the PRO's to Accountants preparing their customers?

1. Gathering: Normally for at least 3 people

Evaluating these preparation administrations can be somewhat dubious; here are some broad rules on how I have estimated my administrations previously:

Along these lines, we should accept that the normal private company spending plan for month to month bookkeeping administrations (counting information passage, accounting, finance handling, deals charge preparing, yearly expense forms and general bookkeeping/monetary counsel) is $500. Presently, bookkeeping firms have a work spending plan (being the biggest info cost) for each customer in light of what they are charging for their expenses, which, for this illustration, we have to expect is the whole customer's financial plan. In this way, the current issue is that 80% of that financial plan is devoured doing information passage and accounting, which has LOWEST PERCIEVED VALUE benefit from the entrepreneur point of view, leaving just 20% accessible for expense forms, money related proclamation translation and business arranging/counseling, which has the HIGHEST PERCIEVED VALUE.

This is the thing that I call the "Administration Level Evolution:"

In this way, the arrangement: Delegate the information passage and accounting back to the customer. Sounds straightforward, at the same time, truly, it's a chaotic experience in light of the fact that most entrepreneurs and their staff don't have formal bookkeeping preparing, and by and large place almost no need in exactness and right characterization of exchanges.

The scaffold between "We do it for you" and "We enable you to decide" without breaking your customer's month to month bookkeeping spending plan is TRAINING. In the event that a bookkeeping firm effectively prepares their customers to do the information passage and accounting precisely and opportune, the measure of cleanup work gets fundamentally lessened, taking into consideration some of that work spending work to be put to better use by concentrating on higher saw esteemed administrations, for example, counseling!

Presently, what are the PRO's to Accountants preparing their customers?

- Billable preparing hours.

- Chance to pick up an inside and out comprehension of customer's tasks.

- Watch associations with numerous staff individuals, and getting a comprehension of the organization culture, which empowers discussions about how money related systems can influence the interworking of the business.

- Seeing how their PC frameworks are setup and what sort of chances there are to enhance IT foundation.

- Watching printed material and exchange work process to find potential holes in inner controls.

- Moves in plans of action from consistence into counseling.

A portion of the CONS:

- Loosing billable accounting/bookkeeping work.

- Managing the inner issues of the organization may require more enthusiastic inclusion from the bookkeeper.

- Customers tend to request a more specialized level of help from their bookkeeper.

- Moves in plans of action from consistence to counseling (which is additionally a PRO).

In this way, how about we examine the TYPES of QuickBooks® Training administrations:

Do you want to know more about QuickBooks Accounting Services ? Checkout here

Do you want to know more about QuickBooks Accounting Services ? Checkout here

1. Gathering: Normally for at least 3 people

- Class Style: No Computers for the clients, foreordained subjects, and unsurprising planning.

- Workshop-Style: all learners have a workstation with the product introduced (ALL MUST BE THE SAME VERSION) or signed into QuickBooks Online on a training organization document. Points can be redone to particular gathering or adjusted to the group and timing might be less unsurprising as a few people are less PC educated than others.

Evaluating these preparation administrations can be somewhat dubious; here are some broad rules on how I have estimated my administrations previously:

- On location One-on-One: Typically, it's level charge for half-day or entire day. "5/9" Rule, i.e. $400 Half Day versus $720 Full day. No unequivocal "excursion charge."

- Remote One-on-One: 1-hour least and 3-hour most extreme hourly rate (i.e. $100/hr). Utilize remote access programming, for example, Logmein or Teamviewer.

- At bookkeeper's office: Slightly higher (i.e. $125 for 60 minutes) than remote, or 2 hours least (i.e. $200 for 2 hours).

- On location Group: Do not charge per "head," but rather, per charge premium, for carrying projector and PC with QB for preparing. I charge per workstation that is conveyed to my customer's office. Redo subjects. Appoint a note taker, as inner systems/forms are probably going to be talked about. Esteem cost in view of number of days.

- Classroom Seminar: Charge per head, offer forceful rebate for gatherings, companions, referrals and the sky is the limit from there. Requires solid reference guarantee/material, as consistency standard is lower than workshop. This implies you have to incorporate a book on a type of access to recordings. Regularly $150-$200 per individual/day.

- Classroom Workshop: Double (or near twofold) the course cost, and permit double an opportunity to cover same subjects that are in the class. It has a higher degree of consistency, however it does requires more opportunity for same measure of themes. More often than not, a book or other reference guarantee isn't required. Common $250-$300 per individual/day.

Quickbooks is accounting software that is used for business. All accounting steps are defined by the QuickBooks. If you need Quickbooks support then you can visit us for the help.

ReplyDeleteIf you have any kind of problems related AOL contact AOL Phone Number

ReplyDeleteI read this post and got information.i must say you way of writing is awsome.

ReplyDeleteAccounting Services for Small Business in London

This is is useful information about your topic . you can also get instant QuickBooks Solution at Quickbooks Customer Service (855) 201-8294

ReplyDeleteQuickBooks provides many features to make your accounting more efficient, such as customer invoices and statements and inventory management. Call QuickBooks phone number at 1-877-603-0806 if you have any questions or need help with your accounting software. They are available 24/7, so it is very convenient for you to reach them.

ReplyDelete